tax benefits of retiring in nevada

Ad Due to the new tax laws relocating to Nevada could have many tax advantages. Even if you are required to source part of your income from a state that has an income tax you may still benefit from a significant reduction to your overall tax burden.

Nevada Retirement Tax Friendliness Smartasset

No Corporate Income Tax.

. Ad We Manage Your Retirement Account So You Dont Have To. The current state sales tax is 685 percent with an additional 125 percent assessed by counties. The statistics show that more people are retiring in Las Vegas and that it is beneficial to them.

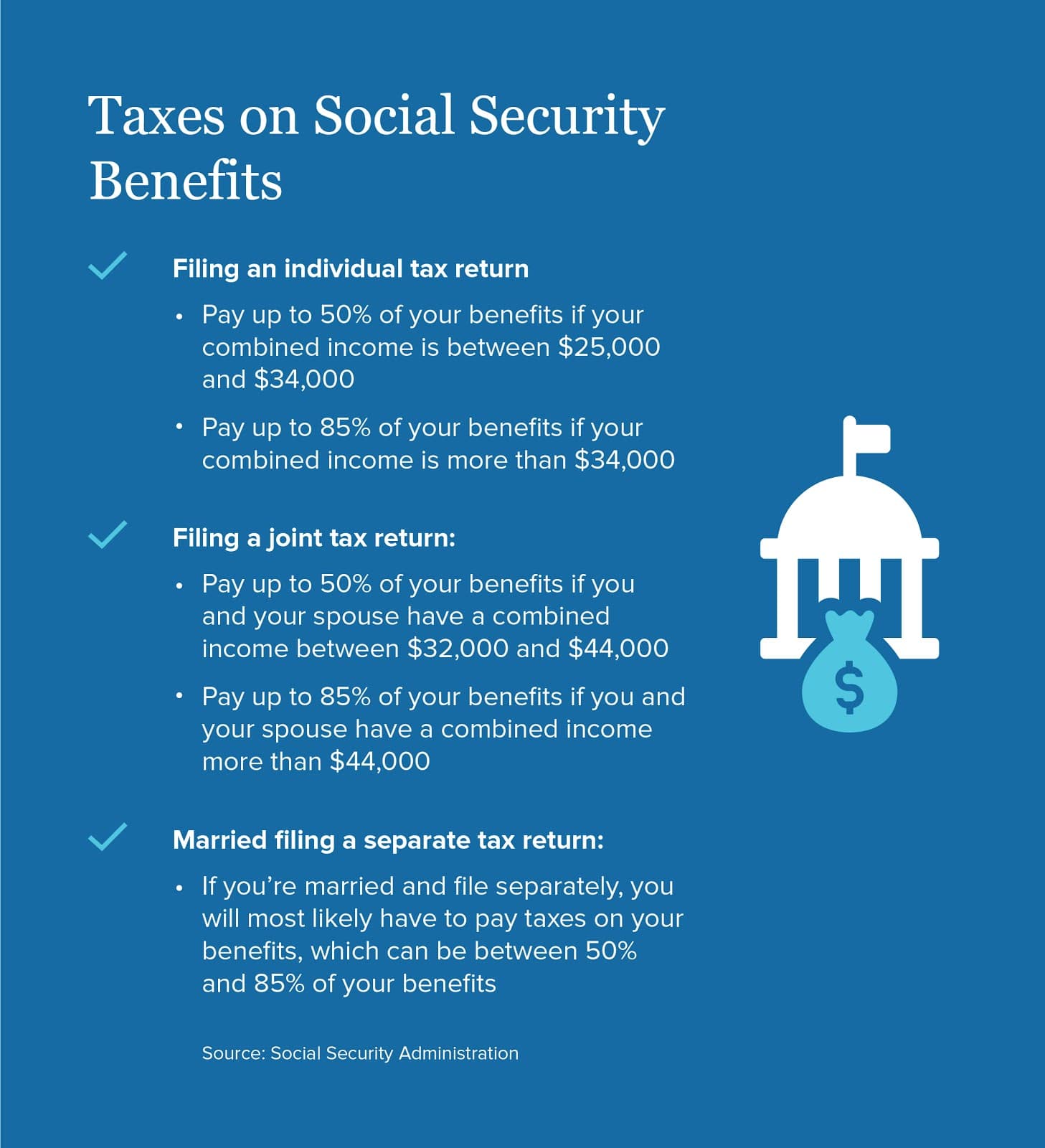

Ad We Manage Your Retirement Account So You Dont Have To. If your income under this definition isnt above the 25000 or 32000 limits your Social Security benefits are yours to keep tax-free. See What Account Is Right For You.

Youll Likely Pay Less in Taxes. According to Sperlings Best Places the cost of living index in Nevada is 102. See What Account Is Right For You.

Regular Members Eligibility for Monthly Un-reduced Retirement Benefit. Regular Members Years of Service Regular Members Age of Retirement. Nominal Annual Fees.

76 of seniors who retire in. No Personal Income Tax. Top Reasons to Incorporate in Nevada.

No Franchise Tax. Residents of Nevada are not assessed a state income tax. Nevada has far more sunny days and lower humidity to enjoy them than most states.

Download our checklist to learn about establishing a domicile in a tax-advantaged state. 10th highest income for seniors in Las Vegas. If you live in these 12 states you need to.

No Taxes on Corporate Shares. Considering the national average is 100 retirement here is going to cost more. In the top 10 of states according to data from NOAA.

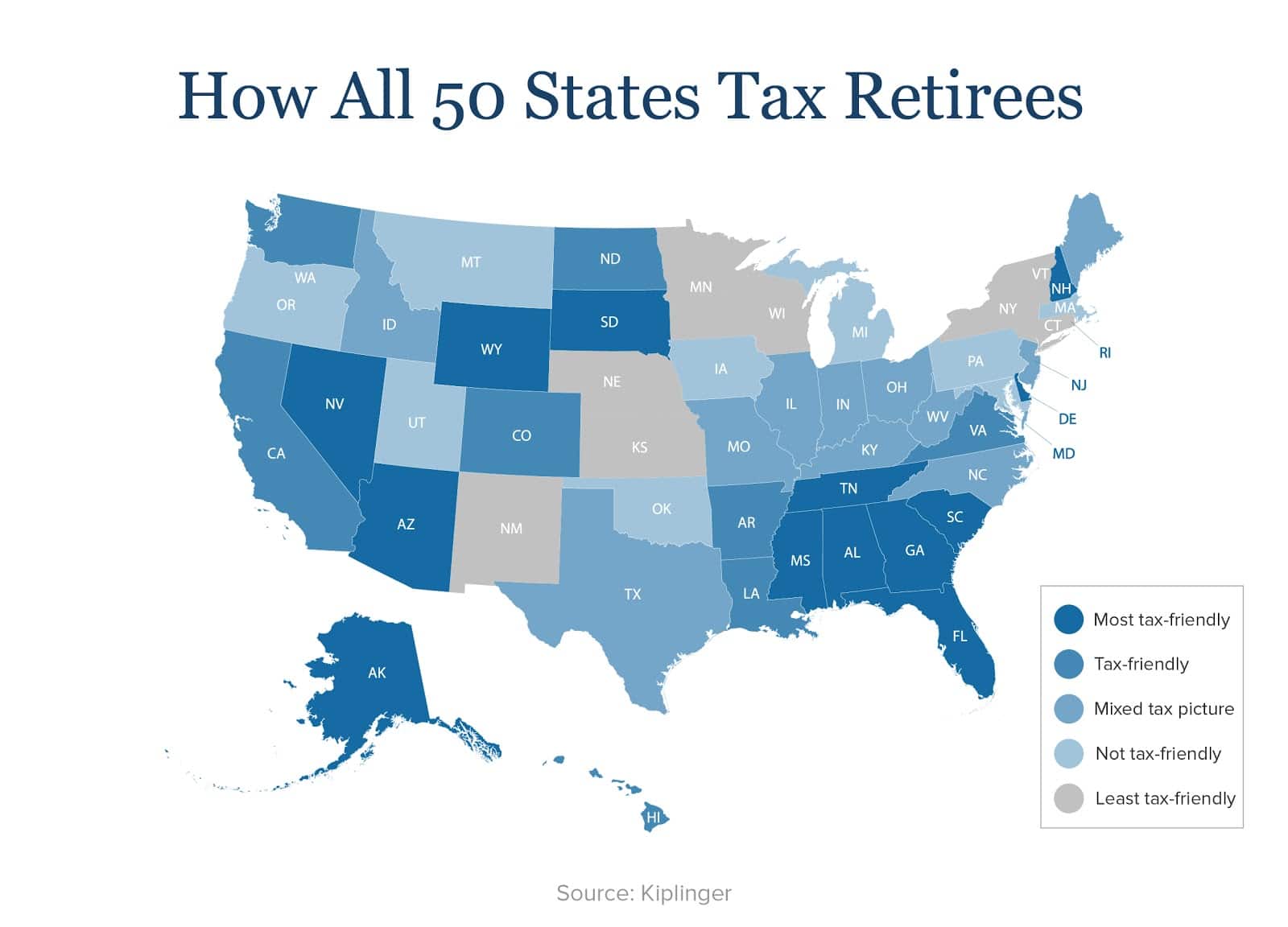

The Most Tax Friendly States For Retirees Vision Retirement

10 Pros And Cons Of Living In Nevada Right Now Dividends Diversify

States That Don T Tax Retirement Income Personal Capital

Best Hot New Restaurants In Las Vegas Nv Las Vegas Las Vegas Hotels Momofuku

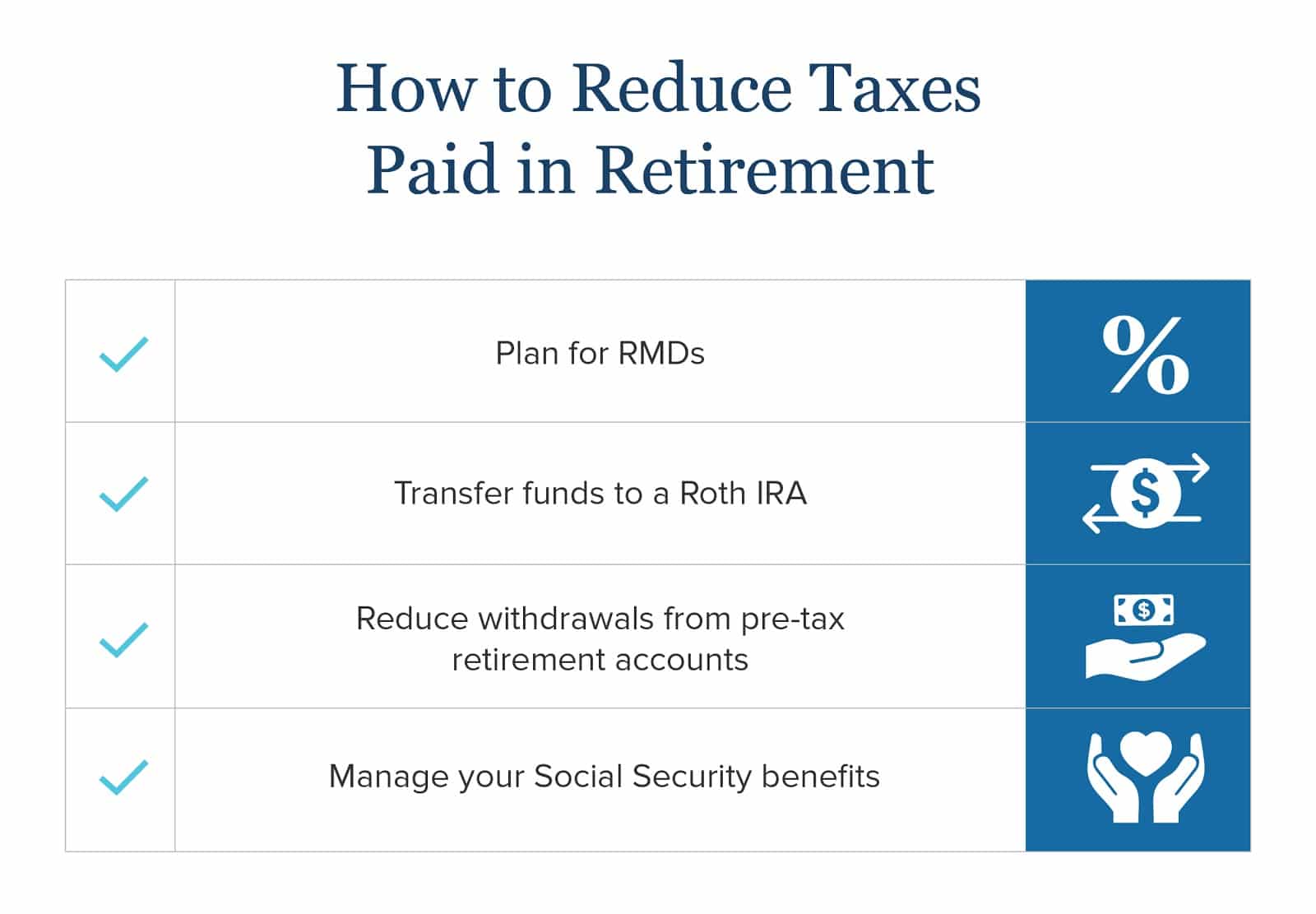

How To Plan For Taxes In Retirement Goodlife Home Loans

A New Report Analyzes How Each State Taxes Or Does Not Tax Social Security Income Social Security Benefits State Tax Social Security

37 States That Don T Tax Social Security Benefits The Motley Fool

Taxation Of Social Security Benefits Mn House Research

How To Plan For Taxes In Retirement Goodlife Home Loans

How To Plan For Taxes In Retirement Goodlife Home Loans

37 States That Don T Tax Social Security Benefits The Motley Fool

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

Choosing A Retirement Destination Tax Considerations Lvbw

Nevada Retirement Tax Friendliness Smartasset

How To Plan For Taxes In Retirement Goodlife Home Loans

Nevada Tax Advantages And Benefits Retirebetternow Com

Nevada Retirement Tax Friendliness Smartasset